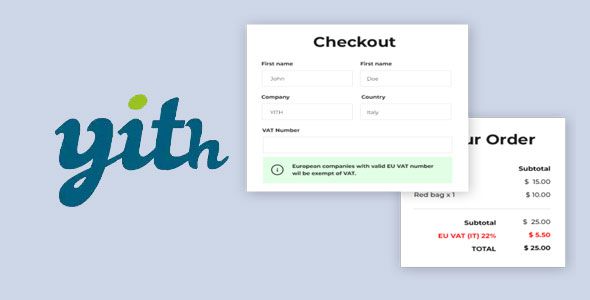

YITH WooCommerce EU VAT, OSS & IOSS

$3.95

Lifetime update

Files directly from the developer

Unlimited use of the website

Full of advanced features

Fast and secure payment

Regularly update new versions

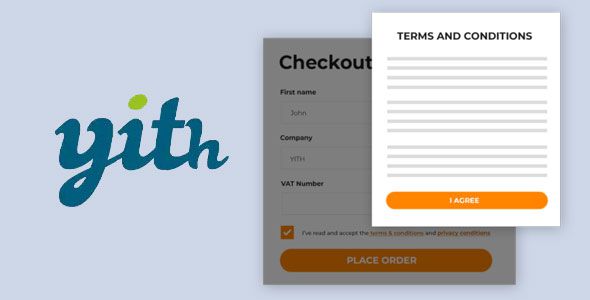

YITH WooCommerce EU VAT is a plugin designed to help WooCommerce store owners comply with European Union VAT regulations. It automatically calculates and applies VAT based on the cusomer’s location and VAT rules, ensuring your store meets EU tax requirements.

Key Features:

- VAT Calculation by Location: Automatically applies the correct VAT rate based on the customer’s country.

- VAT Number Validation: Validate VAT numbers using the VIES (VAT Information Exchange System) for tax exemption.

- Tax Exemption for Valid Numbers: Automatically exempt businesses with valid VAT numbers from paying VAT.

- Customizable VAT Settings: Adjust VAT rules, rates, and applicability as per your requirements.

- Display VAT Number Field: Add a VAT number input field on checkout pages for business customers.

- Country-Based Restrictions: Apply VAT rates and rules based on specific EU countries.

- Customer Role Handling: Treat VAT differently for business and individual customers.

- Tax Reports: Generate detailed reports for EU VAT collection to simplify compliance and filings.

- Multilingual Support: Fully compatible with WPML for multilingual stores.

- Seamless WooCommerce Integration: Works perfectly with WooCommerce tax settings and workflows.

Last Version:

v2.33.0

License Type:

GPL License

Last Update: Jul 10, 2025

By Publisher:

Yith

Live Demo