Easy Digital Downloads EU VAT

$3.95

Lifetime update

Files directly from the developer

Unlimited use of the website

Full of advanced features

Fast and secure payment

Regularly update new versions

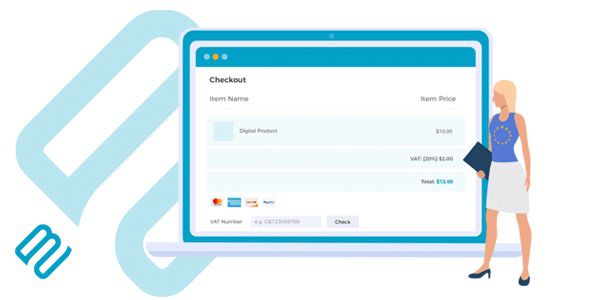

Easy Digital Downloads EU VAT is a robust tool designed to help businesses using Easy Digital Downloads (EDD) to comply with EU VAT (Value-Added Tax) regulations. This plugin simplifies the process of handling VAT for digital products sold to customers in the European Union, ensuring that businesses can focus on their operations while staying compliant with legal requirements.

Key Features:

- Automated VAT Calculation: The plugin automatically calculates the correct VAT rate based on the customer’s EU country, ensuring accurate taxation for each sale.

- Customer Location Detection: Utilizes the customer’s IP address and billing information to determine their location, applying the appropriate VAT rate accordingly.

- VAT Number Validation: Allows for real-time validation of VAT numbers for EU-based businesses, enabling tax-exempt purchases for eligible customers.

- VAT Invoicing: Generates detailed, VAT-compliant invoices for every purchase, including essential information such as VAT rate, customer location, and tax amount.

- Detailed Tax Reports: Offers comprehensive reporting features that summarize VAT collected, simplifying the process of filing VAT returns.

- Reverse Charge Support: Automatically applies the reverse charge mechanism for qualifying B2B transactions, in line with EU VAT rules.

- Country-Specific VAT Rules: Customize VAT rules for specific EU countries, accommodating different tax rates and regulations.

- Integration with EDD: Fully integrates with the Easy Digital Downloads platform, ensuring a seamless experience for managing digital product sales and VAT compliance.

- Compliance with EU Regulations: The plugin is designed to meet all current EU VAT regulations, giving businesses peace of mind that they are in full compliance.

- Easy Setup and Configuration: User-friendly setup with clear instructions and ongoing support, making it simple to configure even for those with minimal technical expertise.

Last Version:

v1.7.3

License Type:

GPL License

Last Update: Nov 7, 2025

By Publisher:

Barn2 Media

Live Demo